Discover a transformative opportunity with the New York government’s incentives, encouraging residents to embrace the future of home comfort through HVAC systems. The NYSERDA Clean Heat Program has your back, covering the installation costs of both ducted and ductless heat pumps, along with heat pump water heaters.

Efficiency at Its Core: The program orchestrates the seamless coordination of heat pump systems, aligning ducted and ductless units with ancillary heating systems. By prioritizing heat pumps as the primary heat source, with ancillary systems standing by as backups, homeowners can enjoy incentives reaching as high as $2500.

Special incentives until the end of May: $4500 for integration from $2500.

Out with the Old: In with the New Bid farewell to outdated fossil fuel heating systems. The program not only supports the retirement of existing appliances in compliance with all laws and regulations but also rewards such eco-conscious decommissioning efforts. When coupled with the installation of an eligible heat pump system, incentives soar as high as $8000.

Special incentives until the end of May: $10,000 for decommission from $800.

The True Cost of Traditional Heating and the Radiant Benefits of Heat Pumps

Traditional heating methods relying on fossil fuels are proving costly on multiple fronts. The New York government’s initiative comes at a crucial time, as prices for last month’s gas bill or the most recent fill-up continue to rise rapidly. Beyond financial implications, these conventional heating sources contribute to long-term environmental damage and pose potential health risks to your family.

Homes Revolutionized with Heat Pumps Equipping your home with heat pumps is not just an eco-friendly choice; it’s a smart financial move. Experience savings of hundreds annually when compared to conventional heating and cooling systems. The positive environmental impact is significant, with carbon dioxide emissions from buildings reduced by approximately 25%. Moreover, enjoy the added perk of a premium, averaging up to $17,000 when it’s time to sell.

As New York takes bold steps toward a greener future, these incentives aren’t just about saving money – they’re about contributing to a sustainable lifestyle. Explore the possibilities, make the switch, and be a part of a cleaner and more efficient tomorrow.

Benefits of Obtaining a Heat Pump Now

Dual Heating and Cooling: In the heart of cold New York winters, heat pumps emerge as versatile solutions, seamlessly transitioning from efficient heating to cooling during the summer.

Efficiency at Its Core: Bid farewell to the conventional struggles with oil, propane, or electric resistance heating costs. Embracing heat pumps typically translates to lower expenses for both heating and cooling your home.

Zoned Temperature Control: Experience a new level of home comfort with heat pumps that allow you to tailor the heating and cooling preferences of individual rooms according to your needs.

Cleaner and Safer Living Revel: in the safety and cleanliness of heat pump systems, where there’s no combustion of fossil fuels, no need for fuel storage, and minimal carbon emissions. Enjoy the peace of mind that comes with the lowest carbon emissions among heating sources.

Simplicity in Every Season: Say goodbye to the maintenance headaches of traditional systems. Heat pumps require minimal upkeep, eliminating the need for fuel deliveries and concerns about fluctuating fuel costs. Forget the annual struggle with installing and removing room/window air conditioners each season.

Inflation Reduction Act Tax Credits: A Game-Changer The Inflation Reduction Act (IRA) stands as a beacon, guiding homeowners towards clean, efficient energy solutions. Offering substantial federal income tax credits until 2032, the IRA opens a significant window of opportunity.

Optimizing Affordability: Combine these tax credits with NYS Clean Heat rebates, low-interest financing, and state tax credits to witness a revolutionary transformation in the affordability of heat pumps. This financial synergy makes adopting heat pumps more accessible than ever before.

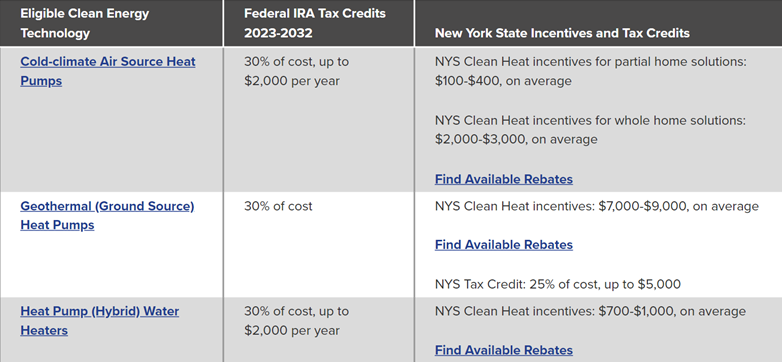

Strategic Tables for Smart Choices: Explore the tables below for a detailed overview of the available tax credits and incentives tailored to different types of heat pumps. Additionally, consider accompanying improvements like electric panel upgrades and home weatherization measures, ensuring a comprehensive approach to enhancing your home’s efficiency and comfort.

Tax Credits and Incentives for Clean Heating, Cooling, and Water Heating

NYS Clean Heat incentive amounts may vary depending on your location and electric utility. Click on Find Available Rebates to see which incentives you are eligible for.

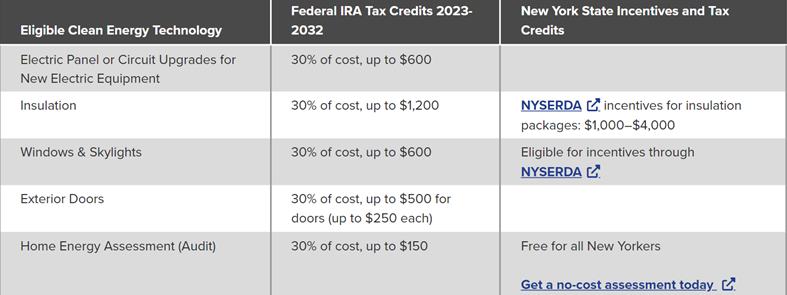

Tax Credits and Incentives for Enhanced Clean Energy Initiatives

Should you be contemplating the integration of a heat pump into your home, it could become imperative to enhance your electric panel. Additionally, a prudent step would involve opting for a complimentary energy assessment, aimed at pinpointing any energy wastage areas within your residence. The strategic addition of insulation or the modernization of your windows and doors could play a pivotal role in optimizing the overall efficiency of your heat pump system.

Optimizing Your Tax Credit Opportunities

The Inflation Reduction Act imposes an overall limit on the total tax credits that a homeowner can receive in a single year for energy enhancements, set at $3,200. This encompasses a yearly cap of $2,000 for any combination of heat pumps, heat pump water heaters, or biomass fuel stoves. Additionally, there’s a $1,200 annual cap for a mix of home envelope enhancements (e.g., insulation, windows, doors), electrical upgrades, furnaces, boilers, or central air conditioners.

To potentially maximize your tax credit benefits, it might prove advantageous to implement improvements gradually. For instance, installing a heat pump heating and cooling system along with a heat pump water heater in separate years could yield more tax credits than a simultaneous installation. Collaborate with your contractor to devise a phased roadmap for improvements, factoring in equipment replacement schedules and potential savings through tax credits and incentives.

Additional Points to Consider:

• Not all equipment qualifies for tax credits or incentives; collaborate with your contractor to select eligible equipment.

• Equipment purchased and installed will be eligible for federal tax credits in the upcoming tax season.

For instance, if you install a heat pump in 2024, you can claim tax credits when filing your taxes in 2025.

Want to know if you’re eligible?

Schedule a free consultation; we’ll assist you every step of the way to acquire your new HVAC system and start saving money and energy.