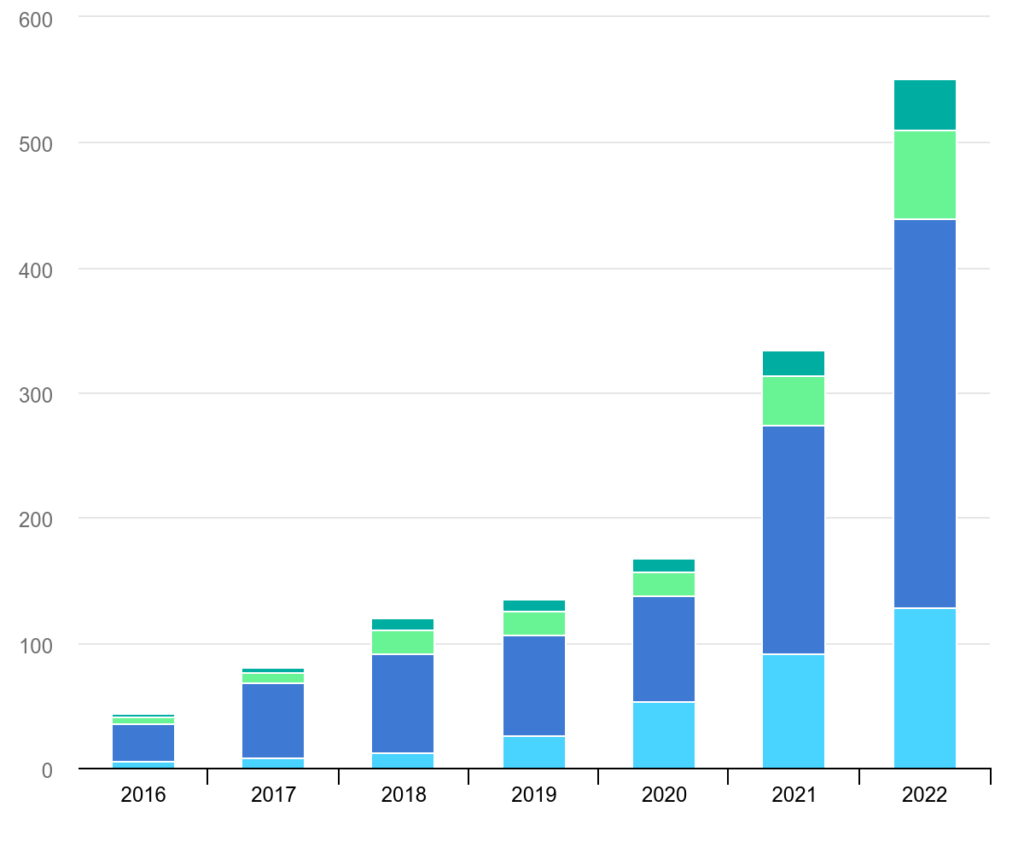

The demand for lithium-ion (Li-ion) batteries in the automotive sector surged in 2022, experiencing a notable increase of approximately 65% to reach 550 GWh, up from around 330 GWh in 2021. This uptick was primarily driven by the expansion of electric passenger car sales, which saw new registrations spike by 55% compared to the previous year.

In China, the demand for batteries in vehicles soared by over 70%, accompanied by an 80% rise in electric car sales during 2022 compared to 2021. However, this growth in battery demand was somewhat moderated by the rising popularity of Plug-in Hybrid Electric Vehicles (PHEVs). Conversely, in the United States, despite electric car sales seeing a more modest increase of around 55% in 2022, the demand for vehicle batteries surged by approximately 80%. Although the average battery size for battery electric cars in the United States only experienced a marginal growth of about 7% in 2022, it still remains around 40% higher than the global average. This is partly due to the prevalence of SUVs in US electric car sales compared to other major markets, as well as manufacturers’ efforts to offer extended all-electric driving ranges.

The global sales of Battery Electric Vehicles (BEVs) and PHEVs are surpassing those of Hybrid Electric Vehicles (HEVs), and since BEV and PHEV batteries tend to be larger, this trend further contributes to the escalation in battery demand.

The rise in demand for batteries leads to an increased need for essential materials. In 2022, the demand for lithium surpassed its supply, a trend that persisted from 2021, despite a 180% boost in production since 2017. By 2022, approximately 60% of lithium, 30% of cobalt, and 10% of nickel were sought after for electric vehicle (EV) batteries. This marks a significant increase compared to just five years earlier, in 2017, when these shares were roughly 15%, 10%, and 2%, respectively. It’s evident that the extraction and processing of these critical minerals must accelerate to support the transition to sustainable energy, not solely for EVs but also to meet the growing demand for clean energy technologies. Finding ways to reduce reliance on critical materials is crucial for enhancing the sustainability, resilience, and security of the supply chain. Innovation plays a key role here, including advancements in battery technology that require fewer critical minerals, promoting vehicle models with optimized battery sizes, and advancing battery recycling methods.

New alternatives to conventional lithium-ion are on the rise

In 2022, lithium nickel manganese cobalt oxide (NMC) continued to dominate the battery market, holding a majority share of 60%, followed by lithium iron phosphate (LFP) at just under 30%, and nickel cobalt aluminum oxide (NCA) at around 8%.

Lithium iron phosphate (LFP) cathode technologies saw their highest market share in the past decade, primarily due to the preferences of Chinese original equipment manufacturers (OEMs). Nearly 95% of LFP batteries for electric light-duty vehicles (LDVs) were installed in vehicles manufactured in China, with BYD representing half of this demand. Tesla accounted for 15% of this demand, with its usage of LFP batteries increasing from 20% in 2021 to 30% in 2022. Approximately 85% of Tesla’s cars equipped with LFP batteries were manufactured in China, while the remaining 15% were produced in the United States using cells imported from China. Overall, only about 3% of electric cars with LFP batteries were manufactured in the United States in 2022.

LFP batteries differ from other chemistries in their utilization of iron and phosphorus instead of nickel, manganese, and cobalt found in NCA and NMC batteries. However, LFP batteries typically have lower energy density compared to NMC batteries. Additionally, LFP batteries contain phosphorus, a vital element used in food production. If all batteries were LFP, they would contribute to nearly 1% of the current agricultural phosphorus use by mass, suggesting potential future conflicts in phosphorus demand as battery usage expands.

In recent years, alternatives to lithium-ion (Li-ion) batteries have started to emerge, particularly sodium-ion (Na-ion) batteries. This battery technology offers a dual advantage: it utilizes lower-cost materials compared to Li-ion, resulting in more affordable batteries, and it entirely eliminates the need for critical minerals, notably lithium. Currently, Na-ion is the only viable battery chemistry that does not rely on lithium. The Na-ion battery developed by China’s CATL is estimated to be 30% cheaper than a lithium iron phosphate (LFP) battery. However, Na-ion batteries do not possess the same energy density as their Li-ion counterparts, ranging from 75 to 160 Wh/kg compared to 120 to 260 Wh/kg for Li-ion batteries. This may make Na-ion batteries suitable for urban vehicles with shorter ranges or for stationary storage but could pose challenges in regions where consumers prioritize longer range autonomy or where charging infrastructure is less accessible. Presently, there are nearly 30 Na-ion battery manufacturing plants in operation, planned, or under construction, with a combined capacity exceeding 100 GWh, primarily located in China. For comparison, the current manufacturing capacity of Li-ion batteries is approximately 1,500 GWh.

Several automakers have already announced plans to introduce Na-ion electric vehicles (EVs), such as the Seagull by BYD, offering a range of 300 km and priced at USD 11,600 (with potential discounts lowering the price to USD 9,500), and the Sehol EX10, produced by the VW-JAC joint venture, boasting a 250 km range. While these initial models may be slightly more expensive than the cheapest small Li-ion BEV models in China, such as the Wuling Mini BEV sold for USD 5,000 to 6,500, they are still more affordable than comparable options with similar driving ranges. For example, BYD’s Dolphin BEV, the second best-selling small BEV in China in 2022, with a similar range to the announced Na-ion cars, can cost over USD 15,000. BYD plans to gradually incorporate Na-ion batteries into all its models priced below USD 29,000 as battery production scales up. These announcements indicate that Na-ion-powered EVs will be available for sale and in use for the first time in 2023-2024, advancing the technology to a readiness level (TRL3) of 8-9, between first-of-a-kind commercialization and commercial operation in the relevant environment. In 2022, the technology was assessed at TRL 6 (full prototype at scale) in the IEA Clean Technology Guide, showing rapid technological advancement compared to the TRL 3-4 (small prototypes) assessment in 2021.

In summary, the current landscape of the electric vehicle industry and its batteries reflects rapid growth driven by the increasing demand for cleaner and more sustainable mobility alternatives.

The rise in electric car sales, along with the diversification of battery technologies, highlights the pursuit of solutions that not only reduce carbon emissions but also address issues related to the availability of essential materials and cost. The introduction of sodium-ion batteries as a promising and affordable alternative signifies significant progress in innovation, signaling a future where the transition to electric vehicles is more accessible and feasible. However, challenges remain, particularly regarding material availability and adapting infrastructure to support the growing demand for electric vehicles. These developments underscore the ongoing importance of innovation, collaboration, and supportive policies to ensure a smooth and sustainable transition to a future of electric mobility.

Are you interested in contributing to a more sustainable future? Start with your home. We’re committed to helping you achieve that goal. By improving your home’s energy efficiency, you can save energy and money while also benefiting the environment.

As a company dedicated to promoting sustainability, we provide complimentary energy audits designed to optimize your household’s efficiency. This not only helps you save resources and reduce costs but also allows you to play a part in environmental preservation.

For residents in New York, it’s important to note that there are various government incentives available to support your efforts in making your home more energy efficient. These incentives, such as tax refunds, discounts, and financing options offered through programs like Clean Heat, Comfort Home, and GJGNY Financing, aim to assist homeowners in transitioning to environmentally friendly and energy-efficient living spaces.

We’re here to assist you in navigating these opportunities by confirming your eligibility and guiding you through the application process if you meet the criteria. By taking proactive measures, we can collectively contribute to a more sustainable and economically viable future.

Schedule your FREE Energy Audit with us today to get started!